Near term U.S. 10-Year note yield outlook:

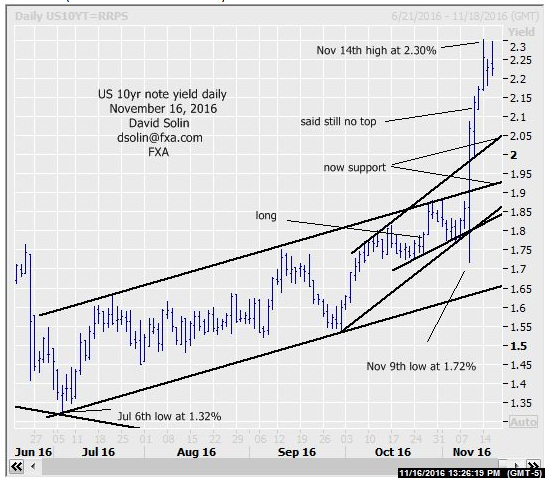

On the Nov 7th email, once again said there was still no confirmation of even a shorter term top "pattern-wise" and the market continued to surge, reaching a high at 2.30% on Nov 14th. Though still no confirmation of a top "pattern-wise" (5 waves down for example), the market is no doubt overbought after the huge surge from the US election low at 1.72% (as well as the larger upmove from the July low at 1.32%) and is within lots of longer term resistance all the way up to the 2.45% area (bearish trendline and 38% retracement from the Apr 2010 high at 4.01%, see longer term below). This in turn suggests that any further upside would likely be limited. Nearby support is seen at 2.15/18%, the broken ceiling of the bullish channel from Oct (currently at 2.03/06%) and the broken ceiling of the larger channel from July (currently at 1.91/94%). Bottom line: still no confirm of even a short term top, but any further upside above the 2.30% would likely be limited.

Strategy/position:

Still long from the Oct 26th buy at 1.79%. But with large profits and any further, near term upside likely limited, would just to take profit here (currently at 2.23%). Though there is still no confirmation of even a short term top, the large risk and likely limited upside makes taking profits a prudent move here.

Long term outlook:

As discussed above, potential for a top is rising as the market is within that longer term 2.30/45% resistance area. Note too that there is some potential for a more major peak to form in this area and with scope declines all the way back to that July low at 1.32%. May be forming a huge falling wedge since that Apr 2010 high, generally viewed as a reversal/ bottom pattern. However, wedges break down into 5 legs and with such a decline seen as the final leg in that long term pattern (wave V, see numbering on weekly chart/2nd chart below). Additionally the 3 wave decline from Jan 2014 to that marginal Jul low (A-B-C) argues a "complex" type pattern (such as a wedge) and view of a longer term topping in the S&P 500 (see email from last week, correlated) add to this potential. However there is still no confirmation of even a shorter term top "pattern-wise" (and larger tops being with smaller ones), so the confidence in this very bearish scenario is not yet high (though given the potential is something to be aware of). Bottom line : some potential of a more major top to forming in this area, but confidence not very high (though something to be aware of).

Strategy/position:

With some potential of a more important top form in this area, would switch the longer term bias to bearish here (currently at 2.23%) and switching to neutral on a weekly close above 2.47% (just above that longer term 2.30/45% resistance area). Must remember that positioning all about risk/reward. In this case, the confidence of a more important topping is not yet very high but the large potential (and limited risk) still makes for a good overall risk/reward opportunity.

Current:

Nearer term : any further upside likely limited, looking to sell but no confirmation of such a peak so far.

Last : long Oct 26 at 1.79%, took profit Nov 16 at 2.23%.

Longer term: bear bias Nov 11th at 2.23%, potential of important topping and limited risk.

Last : bearish bias Oct 3rd at 1.62% to neutral Oct 6th at 1.74%.